- The EdSheet

- Posts

- The EdSheet 2025 in Review | What's In & What's Out for 2026

The EdSheet 2025 in Review | What's In & What's Out for 2026

Hello! Welcome to 2026. This is a special edition of The EdSheet, where I reflect on the past year in the education market and start thinking about what 2026 will look like. I hope you enjoy it. We will resume our regular programming next Thursday (1/22).

As a reminder, The EdSheet covers the business side of the education industry — venture funding, M&A, and other financial transactions. It comes out every other Thursday. Whiteboard Advisors also publishes a daily newsletter — What We’re Reading — of curated, industry-focused news clips and a weekly newsletter — Whiteboard Notes — which covers policy, industry trends, and insights from W/A CEO Ben Wallerstein.

2025 in Review

This is a picture of me from 10 years ago.

I gave 5 AIs this picture and asked them to make a picture of what they thought I looked like today.

Your reaction to these pictures is a litmus test for the 3 possible ways you feel about AI right now:

Holy moly! That looks just like you.

Cool trick. Not sure what this has to do with education.

That is a very convincing picture, I am worried that someone will use it to do you harm.

2025 was supposed to be the year of “AI agents.” I think a more apt description is the year of “AI agency.” When AI reached the point of being good enough to merit a conscious decision over whether, how, and when to embed it into our lives.

It might have happened suddenly. You asked ChatGPT to draft an email to your boss and then never wrote an email from scratch again. It might have been more gradual. After 16 Otter recap emails, you decided to try it for yourself.

Your examples might be different. But I’m willing to bet that there was a point this year where you were prompted to use AI and made a choice to:

Try it

Save it for “next year”

Proactively not use it

To be clear, none of these choices is right or wrong. Especially in the world of EdTech, where the tradeoffs between efficiency and productive struggle are often magnified. But, once you’ve made your camp, it is hard to break free.

Fierce debates about AI hung over an education industry that was already experiencing one of the most challenging years in recent memory. Education leaders were forced to navigate a whirlwind of real, attempted and, at times, exaggerated policy changes, from attempting to shutter ED to freezing billions in federal funding, (finally) passing Workforce Pell, and the continued rise of education savings accounts.

As predicted, the EdTech funding winter also continued. Private capital for education companies is at its lowest point since I started tracking transactions in 2022, and likely since ~2015, when now-stalwart EdTech venture funds like Reach Capital, Owl Ventures, and GSV started scaling up to meet demand for the burgeoning sector.

By dollar volume, venture funding is down 28% YoY. Transaction volume for M&A and buyouts — which I prefer for evaluating because deal size is infrequently disclosed — was also down by 24% and 28% YoY, respectively.

There were a few noteworthy bright spots, which I’ll get to in a minute, but the overall picture is bleak. In 2023 and 2024 we thought that the funding downturn might just be a reversion to pre-COVID norms; as activity continues to fall, it seems the trend may just be down.

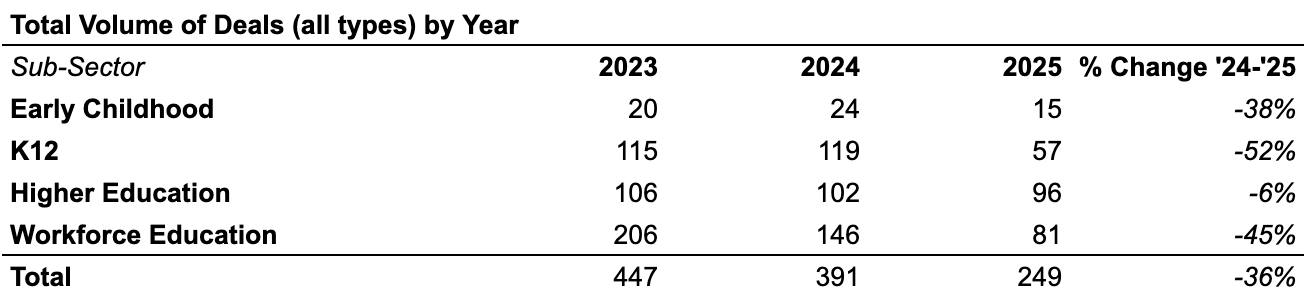

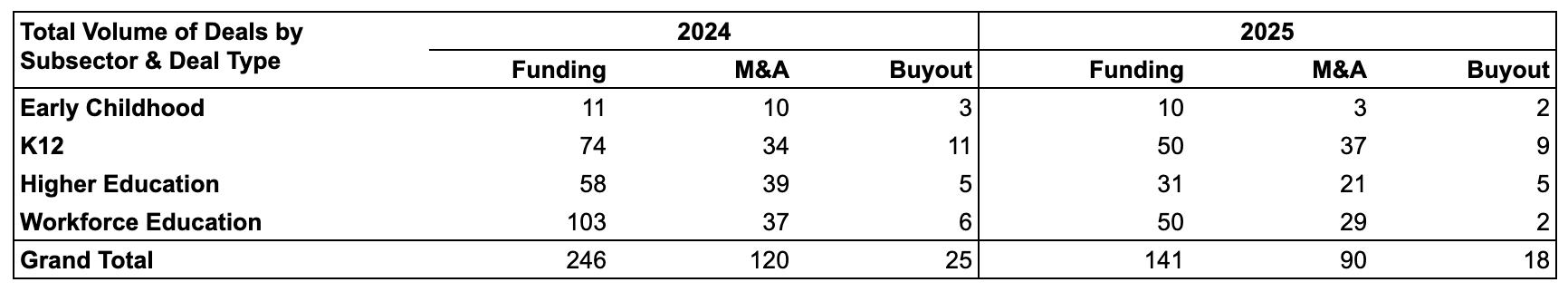

To dig in deeper, here are a few different cuts at this year’s transactions data that are informing my perspective:1

Source: EdSheet Deals Database

Source: EdSheet Deals Database

The decline in transaction volume is consistent almost across the board, by sub-sector and deal type (K12 M&A is the exception). Curiously, this pattern was most stark in the Workforce sector, which has propped up the education venture market over the past few years.

It is possible that the decline in workforce deals is the result of companies cutting jobs and redeploying talent management spend towards AI infrastructure (thus, shrinking the potential market for companies in the workforce space), but it is too soon to tell. I suspect deal volume for the workforce sector will bounce back in 2026.

I do not expect overall transaction volume to recover much in 2026, particularly in venture, for two reasons:

First, there continues to be too much existential uncertainty about what the big model providers will do for generalist investors to get excited about EdTech. Getting “Chegg’d” is now a pejorative in financial markets and each of OpenAI, Anthropic, and Google announced significant product launches specifically for the education market this year. Big Tech could crush an EdTech company at any moment.

Second, the bills are coming due for EdTech specialist investors, many of whom raised funds in 2020-22, at the top of the EdTech market. There are relatively few big venture markups, and even fewer big venture exits, to justify raising new, EdTech-specific funds.

Note: Some EdTech funds are navigating this risk by changing their fund strategy or expanding their mandates beyond education. SemperVirens, the closest thing to a traditional EdTech manager to announce a new fund this year, joined several other funds in reorienting towards growth equity and buyouts of larger companies. (A strategy which appears to be more resilient to the AI wave or, at least, has more concrete data to inform valuations.)

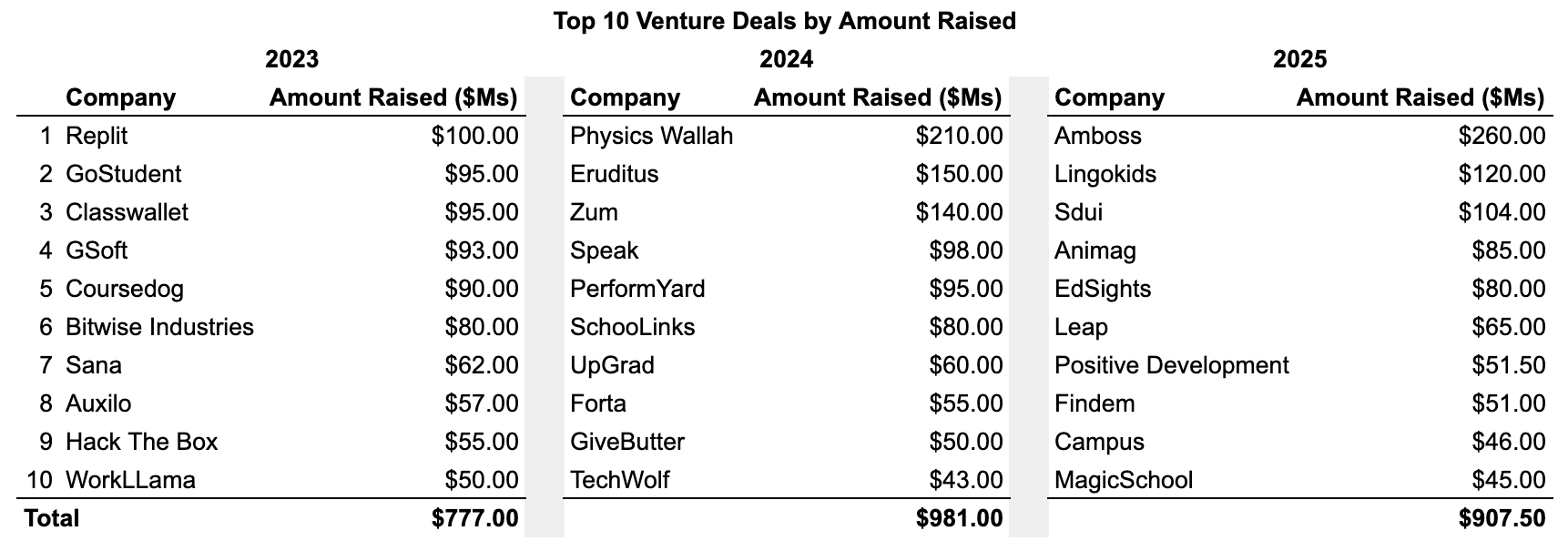

That said, there are some bright spots for the venture market. The dollar volume of funds raised for the top 10 venture deals of 2025 compares favorably to 2024 and is actually higher than 2023, before the market started really backsliding.

Source: EdSheet Deals Database

Which brings us back to agency. In the world of EdTech, like most sectors, there has always been a valuation premium on companies that proactively shape their destinies. This is especially true in a moment when policy is in flux and advances in AI happen seemingly every week.

There are 3, non-mutually-exclusive ways for companies to do this, each of which can be seen in this year’s top 10 venture deals:

Build your go-to-market channel: Trusted, proprietary channels, especially in risk-averse markets like education, will be the hardest (though not impossible) for “AI” to unseat. 5 of the top 10 venture rounds this year went to companies — Amboss, Lingokids, Animag, Campus, and MagicSchool — built on top of strong direct-to-consumer channels.

Increase your velocity: AI-enabled software development is an order of magnitude faster than traditional software development, allowing companies to deliver new features and scale faster than ever. Where companies used to raise new funding every ~18 to 24 months, no fewer than 8 EdTech companies, including Sdui, Campus, and MagicSchool, have announced 3+ venture rounds in the past 3 years. Starbridge, whose $42M Series A just missed the top 10 cutoff, announced multiple 8-figure venture rounds this year.2

Control your own policy destiny: OpenAI could build a developmental therapy for autism, as Positive Development is working on. But they probably won’t because the legal/reputational risk and specialization required outweighs the revenue potential relative to other products they could be building. As the battle over AI regulation progresses, I expect companies to invest more heavily in defining their markets at the legislative level. And to see Big Tech more obviously cede portions of the most heavily regulated markets, like Special Education, to specialized players.3

My point in bringing these themes up is that the EdTech market is not dead — there are good education investments out there. But funding for EdTech businesses is increasingly reserved for companies who have shifted their assumptions towards competing against AI — those who demonstrate agency rather than reactivity in response to macro trends.

Alas, that shift is not simple. It requires people — you and I — to invest the time and money to “try it” before their organizations can. That is happening, but I expect it to take at least another year before we see the results spreading beyond the highest-performing companies in the industry. I expect venture funding to be ~flat for 2026, tough sledding for most of the industry.

To learn more about the year in education financial transactions, I’d like to share one of my most exciting “AI moments” this year — the EdSheet Deals Database. I’ve had a notion for what this application could look like for going on 4 years, but have never had the means to make it happen. Until New Year’s Eve, when I sat down for my once-a-quarter vibe coding session and…it just started working.

Please note this app is 100% vibe-coded and still very much in beta, but I hope you’ll check it out and let me know what you think!

What’s In and What’s Out for 2026

These are not necessarily predictions, nor are they limited to 2026, but rather things I think need to be said out loud.

What’s in

Whole milk and real food: Much ink was spilled last year on the various ways student performance/test scores are rising or falling. Little/none considered whether hunger might have played a role in these results. The debate here is, unfortunately, couched in partisan politics (and decades of lobbying), but the renewed emphasis on real food will be positive for students. For more on this topic, check out my recent conversation with Lunch Bunch CEO Natasha Case.

Custom instructional/training content: LLMs allow the creation of content at a speed and scale that was unimaginable pre-2023, creating one of the hottest categories in education. This will lead/has led to many snake oil salesmen. But, for the companies who have focused on empowering experts rather than displacing them, it has led to both positive outcomes and funding. Magic School, SchoolAI, and Brisk Education raised $85M last year to provide teachers with custom instructional materials and I would not be surprised to see one of them — and/or a close corollary in corporate training/simulations — appear in next year’s Top 10 list.

Next-gen universities: More and more people may be questioning the value of college, but that does not mean post-secondary education is going away. Expect to see new post-secondary models — and a new federal funding stream — to rise in prominence in 2026, building on the ~$90M in venture funding that Campus, Outsmart, and the Tetr College of Business raised in 2025. Also keep an eye on the traditional schools executing new strategies for differentiating themselves, like Northeastern and Vanderbilt’s efforts to build global campus footprints.4

School choice: School choice continues to ride a massive wave of support, headlined by OBBBA’s introduction of a federal tax credit scholarship program which will go into effect in 2027. I expect the discourse over school choice to grow more nuanced and bi-partisan over the course of this year — you might see more words like Educational Pluralism and more op-eds embracing elements of choice from respected leaders on the left side of the aisle.

What’s out

Uncapped student loan debt: Uncapped loans — of any sort, but particularly those targeted at a young, impressionable and literally uneducated cohort — are not a good idea. The implementation details matter here, but it is worth noting that the new student loan caps will impact just 28% of graduate borrowers, most of whom will have program alternatives with expected borrowing under the caps. (In nursing, frequently cited for being snubbed from getting the “professional” program designation with higher loan caps, 95% of students will not be impacted.)

Companies with the word “AI” in their names: The best AI use cases are those that can be explained without using the word “AI.” Too many people and organizations have been using “AI” as a filler word to paper over claims and schools, districts, and even states are threatening to push back. I expect 2026 to be a retrenchment, or at least rebranding, year for many companies who leaned heavily into the AI buzz from 2023-25.

Whiteboard Advisors is the leading policy-related diligence partner for education investors, advising on most major private equity transactions in education over the past 15 years. Our specialty is translating complex policy dynamics into insights that inform decision-making. Reply to this email to learn more.

1 This list does not include Cengage's $500M raise in 2023 or Anthology's $250M raise in 2024, as these organizations were already PE-owned at the time of investment and, thus, the investment structures were different than traditional venture. Bitwise Industries' $80M venture round also turned out to be extremely fraudulent, but did have traditional venture terms.

2 There are wrinkles to this trend. Anecdotally, there are a number of companies that raised a single round of venture funding to get started and do not intend to raise again. Others raised money but chose not to publicly announce the raise. These trends are interesting but are hard to track (or write about) objectively.

3 We will see if Google and Character.AI’s settlement with the parents of Sewell Setzer III — who committed suicide in February 2024 — provides a (horrifically sad) test case for this calculus.

4 It turns out that this prediction has already come true, with Vanderbilt announcing their new San Francisco campus on Tuesday. You will have to trust me that I wrote the prediction before reading the announcement.